By Sharon Arnolda

“How a company is governed influences rights and relationships among organisations and its stakeholders, and ultimately how it’s managed – whether it succeeds or fails. Companies do not fail, Boards do.”

— Richard Le Blanc

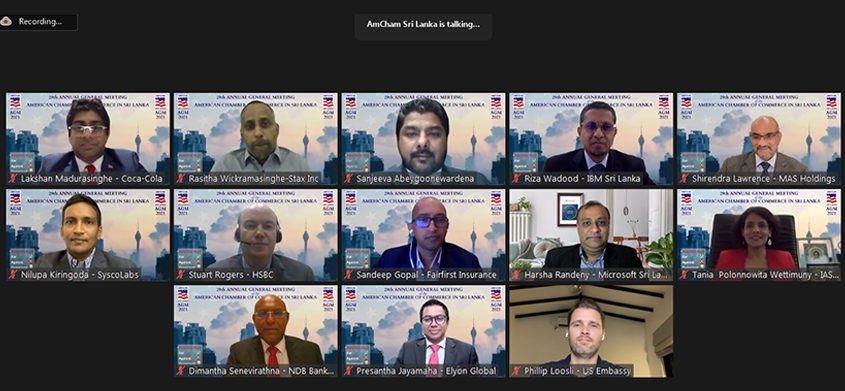

The seventh webinar series of the SL Law Review series hosted by American Chamber of Commerce in Sri Lanka (AMCHAM) focused on corporate governance and directors’ duties, the enlightening discussion was panelled by President’s Counsel Dr. K. Kanag-Isvaran, Legal Counsel Nilshantha Sirimanne, Legal Counsel Ameer Maharoof, and was moderated by Attorney-at-Law Shalinie Kulatunga.

What exactly is corporate governance?

In a nutshell it’s the policies, regulations and rules that control a business’ behaviour, it’s affected by the legal, regulatory and ethical environment that surrounds a company; good corporate governance results in a well performing, sustainable business with a culture of integrity; at the centre of all of this lies the Board of Directors. In initiating the discussion, Sirimanne’s presentation focused on the role of a director, the historical underpinnings of the now well-established role and its influence in good corporate governance.

In initiating he explained the concept of a company being a separate legal entity in the eyes of the law, which in turn enables an organization to own assets and carry out transactions in its name; these tasks are carried out by the Board of Directors, he added. He explained that historically the director played a fiduciary role in the company; similar to that of a trustee, carrying out activities for and on behalf of the company and acting solely in its beneficial interest. However, he went on to explain how the role has diversified from its initial fiduciary standpoint.

In some instances directors are considered as agents in entering agreements with third parties. According to section 529 of the Companies Act, the term is given a broad definition and includes all individuals who perform the key functions of a director even though they may not necessarily have the job title of one. In further elaborating on the nature of its definition Sirimanne explained that it also covers concepts such as ‘Shadow Directors’, in which influential majority shareholders are not directly a part of the Board of Directors but silently instruct and influence the decisions of the Board.

He went on to state that even though such directors are not disclosed under Form 20 ( A form filed annually with the registrar of companies declaring all the directors of a company), since they fall within the gambit of the definition given in the act they too are bound by the duties and obligations laid out in the Act. He added that directors can therefore be broadly categorized into executive, non-executive, shadow, nominee, and may even be employed on a contract basis by the company and are responsible for running, maintaining, and supervising the organization and its activities.

Riveting to the discussion on the historical underpinning of the role, Sirimanne shared the brief evolution of the role, from its inception in English legal principles, he went on to add that in the 19th and 20th century the fiduciary nature of the directors obligations were so laxed in its interpretation that the standard of duty and care owed by a director to a company was very low. The preceding Companies Act therefore reflected similar legal principles. However, with the introduction of the Act in 2007, the role of the director and the duties and obligations have been clearly laid out, he added.

In a nutshell, he went on to elaborate that the Act lays the obligations for a director to act for, “Proper purposes,” and in accordance with the articles of the company. He further elaborated on the duty of ‘minimum care’ imposed by the Act, the section which he referred to as a, “Clever section,” lays out both an objective and subjective standard of care. He went on to state that according to the subjective approach a director’s duty of care will be subject to a higher standard, taking a director’s educational qualifications and so on into consideration as opposed to other directors who are not as qualified or experienced.

In other words, a director’s responsibility to the company can and will be individually assessed based on their individual qualifications resulting in more liability for their actions accordingly. In addition sections 187 – 200, and sections 219 and 220 impose duties during insolvency, in addition to which other laws such as the EPF and ETF Act also impose obligations and regulatory measures on the role of the director, he added.

He went on to state that while a director can delegate his duties to another party, the director is bound to supervise the appointed delegatee, a director has to be, “Hands on,” in the running of the company, he added. Even though there is a common misconception that the primary duty of a director is to the shareholders the general rule is that a director’s primary duty is to the company, however under special circumstances a duty can be owed to other stakeholders of an organization

— Nilshantha Sirimanne

How did the concept of corporate governance come into existence?

In drawing an example from the lack of corporate governance practises in the recent past, Sirimanne elaborated on the issue of ‘Golden Key’, a situation which left many people in dire situations and required the Government to step in to settle the payments that were due. He went on to state that such occurrences that adversely affect investor and stakeholder trust resulted in the development of the concept of corporate governance in the UK and the USA in the 1980’s. Corporate governance therefore, aims to reduce the adverse impact caused by the negligent management of companies.

Therefore, in its widest definition it deals with the relationship between the company and who owns and controls its functions, and in its broader definition deals with the relationships between a company and all of its stakeholders. In closing Sirimanne shared three reforms that have been brought about by corporate governance.

1. The separation of the role of Chairman, Managing Director and Chief executive officer: He added that prior to this change that there was too much power vested in one person who in turn has too much dominance over the Board.

2. Reforms to the role of nonexecutive directors: This brought in checks and balances on the actions of directors and promoted independence and the representation of stakeholders on the Board.

3. Subcommittees of the Board: Subcommittees mainly deal with four aspects of the running of a company, namely; Audit, Risk and Strategy, Remuneration, and Talent. The committees that mainly consist of non-executive directors and in turn ensures that there is representation and the daily functions of the company are not monopolised purely by the Board.

Has the pandemic had an impact on the duties and obligations of the directors?

In tackling the question, Dr. Kanag-Isvaran stated that the pandemic has had no impact on the duties owed by directors and the role and duties of the same remains the same even in the light of the pandemic, even though the proposed COVID Bill might bringing laxatives when it comes to timings he added. Elaborating on his predecessor’s comments, Dr. Kanag-Isvarn took the opportunity to further elaborate on the liabilities imposed on directors, which can arise in three ways; Criminal liability, Civil liability, and Tortious Liability. He pointed out that the concept of ‘limited liability’ gives rise to a situation in which directors cannot be sued directly for the shortcomings of the company.

Who can ideally sue directors?

As explained earlier, a director’s duty lies to the company and therefore, the company can sue a director for the breach of such duty and the consequences of it. However since a company is also run by the Board which is given sole control of the functioning of a company through section 184 of the Act this doesn’t often happen, he added. The Act provides for mechanisms in which a director of a company may be held personally liable in respect of their actions. The Act provides for ‘derivative Actions’ in which a shareholder can sue a director.

Such actions require leave of the court and in the event, the directors decide to take up such matters internally and such an action will not proceed in court. The Act provides for instances in which a director may be liable to pay through assets of the company or personal funds. In the event of distribution of funds, a director cannot distribute funds unless the company is solvent or has declared insolvency. Failure to obey the rules can result in the director being personally liable or will be liable to compensate through the assets of the company.

A similar approach is taken in the event of unapproved personal loans and mishandling of remuneration. In the event of fraudulent trading is where ‘during the course of winding up’ it is brought to light that a company had intention to defraud another party. Tortious liability is where a liability arises under a contract. For example, directors can be held personally liable if misinformation is included in any prospectus prepared by the Board. In ending Dr. Kang-Isvaran added that relief from liability can be obtained if a director can prove that his actions are honest and reasonable. In sharing his thoughts on the matter Maharoof added that, the only change that may arise out of the pandemic is that a higher standard of diligence and care can be expected of directors in dealing with the current situation.

What additions are required to corporate governance to face the current situation?

In answering, Dr. KangIsvaran shared that companies should look into the quality of the Board making the decisions. The final decision on the internal management of a company lies with the Board. Further, English law recognises that the law would not interfere in the management of the company if the directors are acting within their power and that an obligation cannot be imposed based on a decision that proved to be wrong in hindsight.

In further elaborating on the concept of ‘due care and diligence’ that is required to be exercised by the Board in making a decision, he stated that a Board is required to make a decision in the best interest of the company based on the facts and figures at the time. In other words, a decision that seems wrong in hindsight cannot be held against the Board if the board was acting with reasonable care and made the correct decision at the given time.